For Taxonomy Assessment under Annex D, ESG Risk Management, and CSRD Disclosure

Climcycle also supports this task in a straightforward manner. In the European Union, biodiversity is already enshrined in the so-called taxonomy regulation. The sixth environmental objective specifically references biodiversity and ecosystem protection. The calculation and disclosure of biodiversity risks are also part of CSRD & ESRS. Therefore, the impact on our ecosystems must be assessed and communicated by all companies in the EU in the coming years.

All-in-one, always there for you, and sustainably well-designed.

To optimize user-friendliness, the input fields have been kept to a minimum. In addition to the address of the location to be evaluated, the activity, construction type, remaining useful life, and, if applicable, the book value must be defined. The output data is regulatory-compliant and at the same time intuitive, simplifying processes for you in a sustainable way.

This Climcycle module is based on publicly available data sources selected according to regulatory recommendations. Through risk identification, individual vulnerability analysis, and subsequent adaptation solutions, anticipated financial effects can be determined and disclosed.

Up to 9 acute and chronic biodiversity risks are addressed to obtain a conformity assessment according to Annex D of the EU Taxonomy.

ModulePages.biodiversity.differentiaton

Whether you're a financial institution, insurance company, or industry leader, we provide the solution for all your ESG regulatory needs. With Climcycle, you get a platform tailored to your specific requirements.

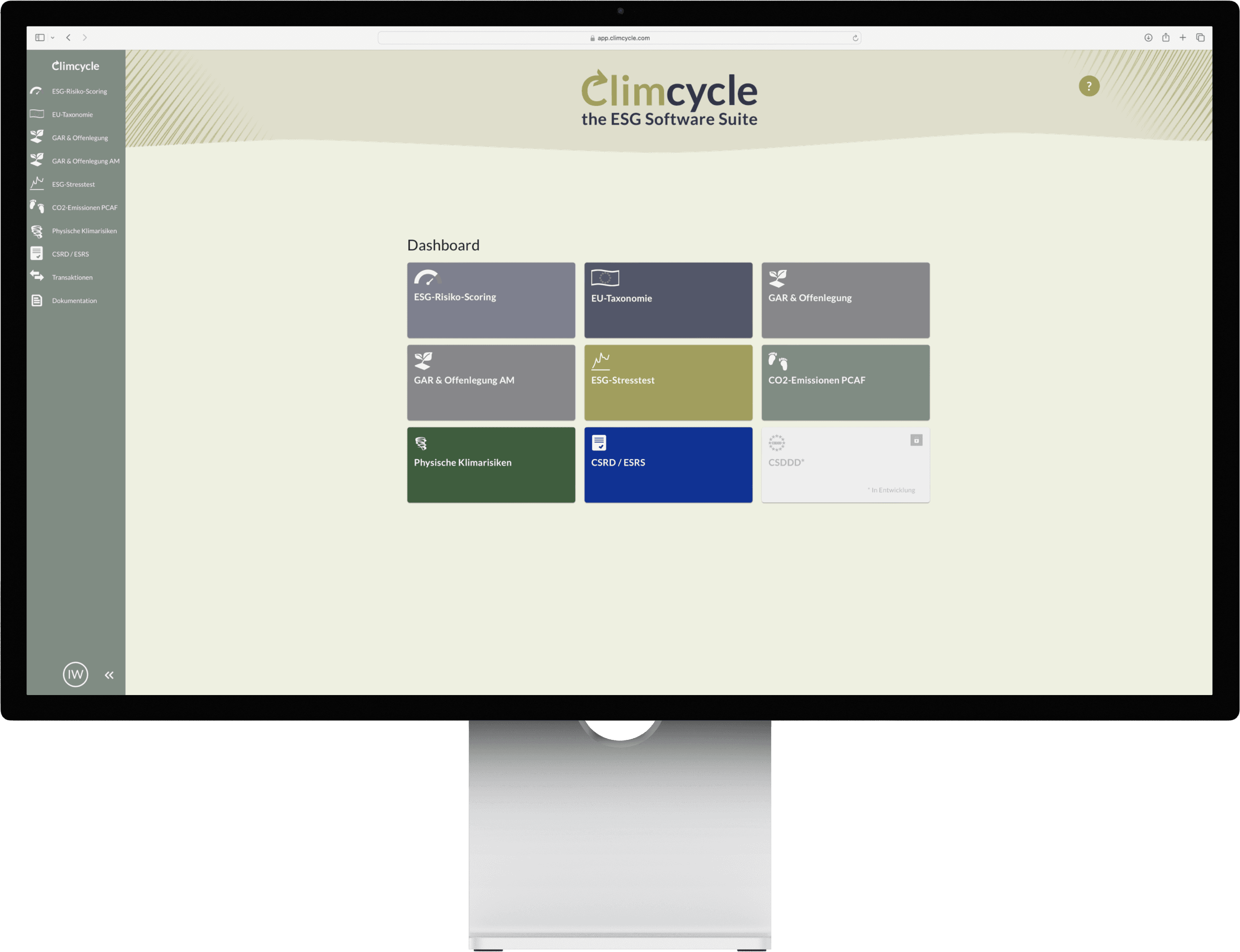

Choose your modules

Customized adjustments

Key features

Being ESG-compliant from a regulatory perspective: that is the purpose of Climcycle's 9 different modules, all working towards a common goal. Whether it's one module or all of them – customize your individual solution.