Calculation of financed emissions

Complexity is a thing of the past, as Climcycle uses the established PCAF standard to calculate financed emissions. It provides a framework for calculating, attributing, and disclosing financed emissions – Scope 3, Category 15, Downstream. The bank’s portfolio is divided into seven asset classes, where emissions are assessed on both transaction and portfolio levels. The calculation options depend on the quality and availability of the required data and can be chosen individually for each transaction.

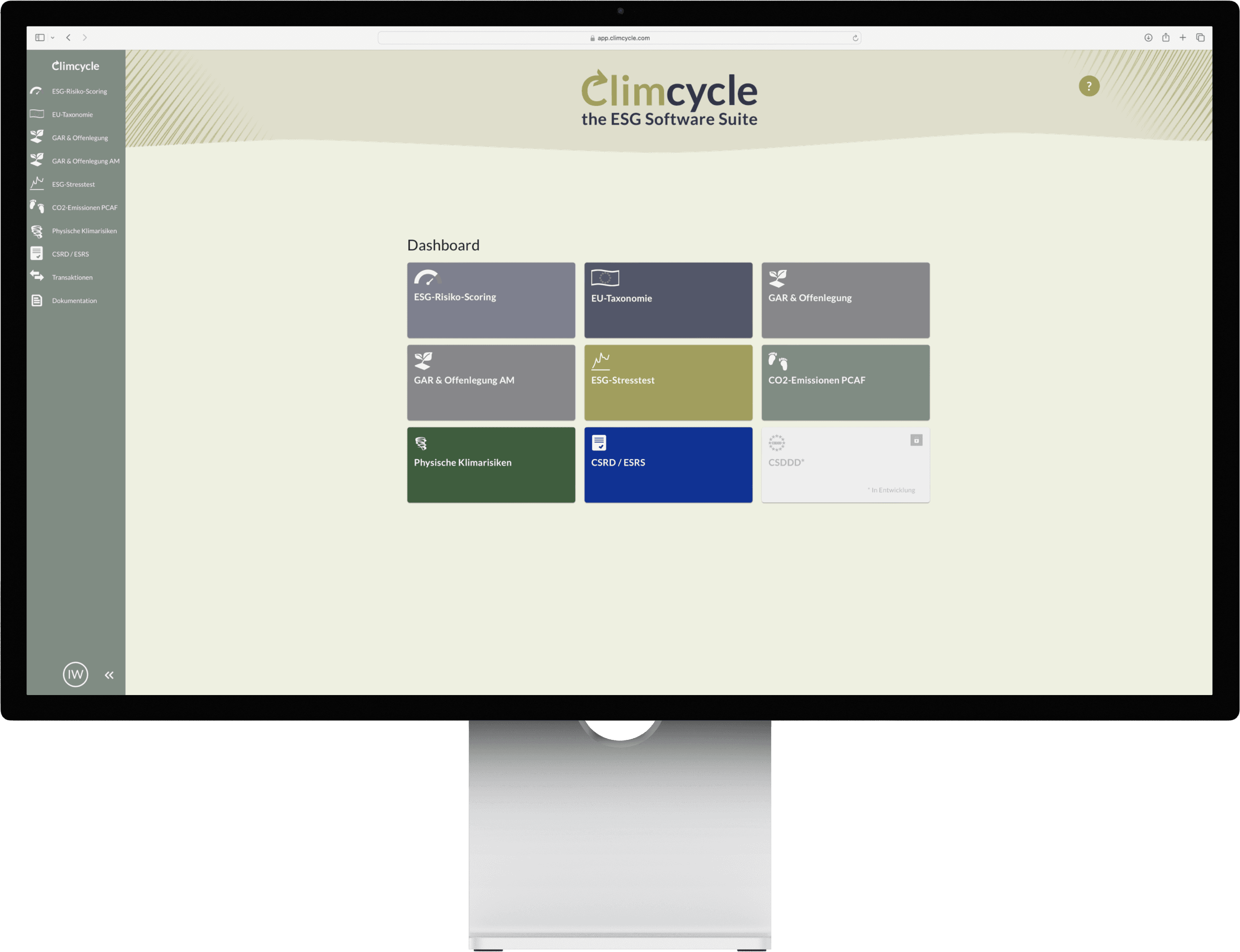

All-in-one, always there for you, and sustainably well-designed.

The data requirements are based on the PCAF framework and include, for example, individual company data, building type, car model, or information on the region and industry. Calculations are performed at the transaction level and can be aggregated at the portfolio level. The output includes absolute financed emissions, CO2e emission intensity, and the quality score.

The PCAF module of Climcycle follows the framework of the PCAF standard and offers various calculation methods depending on the granularity of available data. For each asset or deal, the calculation method can be chosen individually according to data availability to keep things as simple as possible for you.

The module covers the following asset classes: publicly traded equity and corporate bonds, business loans and unlisted equity, project finance, mortgages, commercial real estate, auto loans, and sovereign bonds. The data sources used include all regions and industries.

All analyses are performed at the deal level. Climcycle uses as differentiated data as possible, both internal and external. If individual data is not available, Climcycle falls back on industry and region averages.

Whether you're a financial institution, insurance company, or industry leader, we provide the solution for all your ESG regulatory needs. With Climcycle, you get a platform tailored to your specific requirements.

Choose your modules

Customized adjustments

Key features

Being ESG-compliant from a regulatory perspective: that is the purpose of Climcycle's 9 different modules, all working towards a common goal. Whether it's one module or all of them – customize your individual solution.