For Taxonomy Assessment under Annex A, ESG Risk Management, and CSRD Disclosure

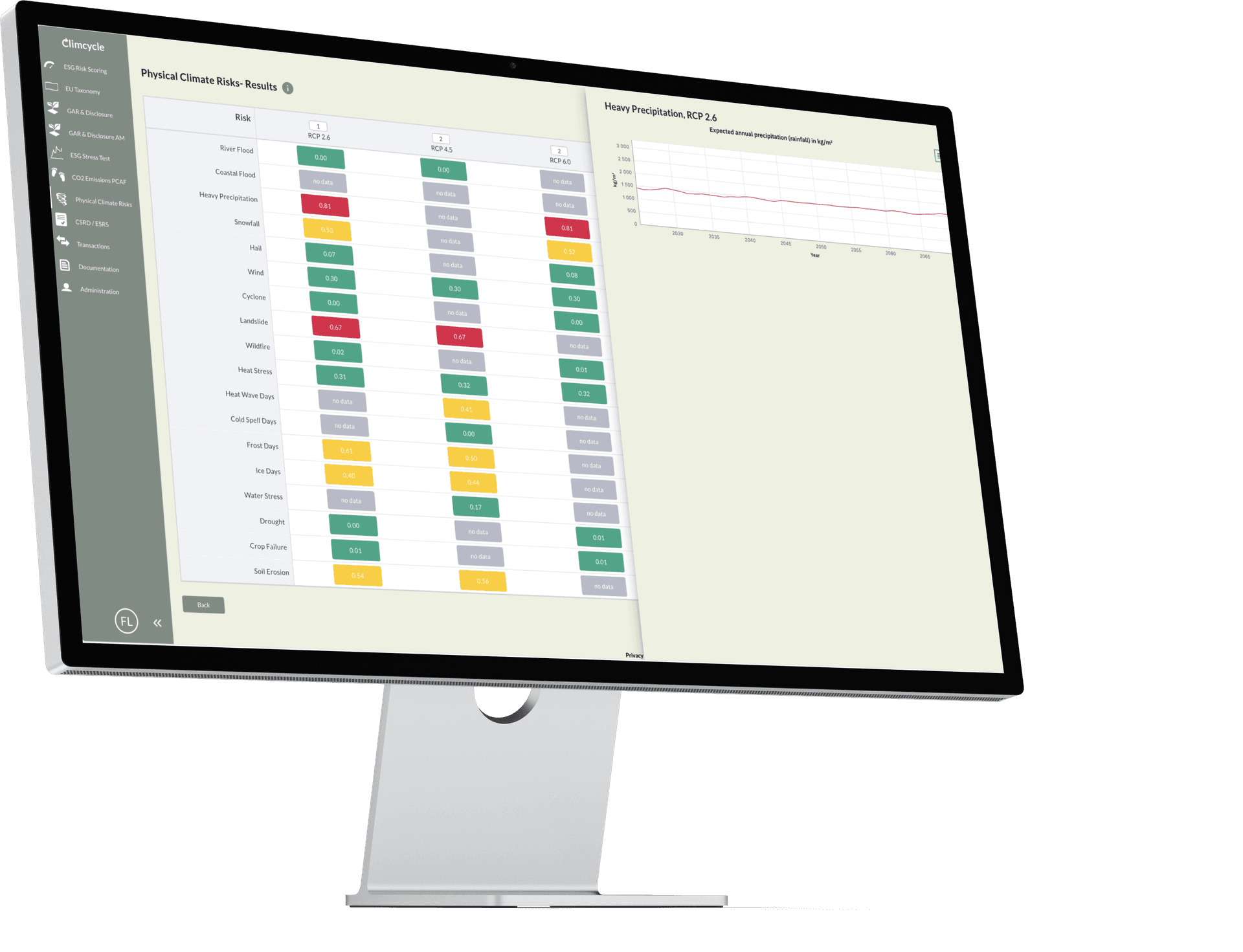

Climcycle uses the data sources proposed in the EU taxonomy regulations to assess site-specific physical climate risks. This regulation also provides a framework for identifying, projecting, and assessing physical climate risks. Up to 18 acute and chronic climate risks are projected using climate scenarios (RCP scenarios) up to the year 2100 to obtain a conformity assessment according to Annex A of the EU taxonomy.

All-in-one, always there for you, and sustainably well-designed.

This Climcycle module is based on the most granular freely available climate data and the legal requirements of Annex A of the EU taxonomy.

To optimize user-friendliness, input fields are kept to a minimum. In addition to the address of the site to be assessed, only the start and end date need to be defined. Optionally, the type of economic activity can also be specified to filter out irrelevant risks.

The model is continuously updated with the latest climate research findings and available climate risk data, thus optimizing processes.

Whether you're a financial institution, insurance company, or industry leader, we provide the solution for all your ESG regulatory needs. With Climcycle, you get a platform tailored to your specific requirements.

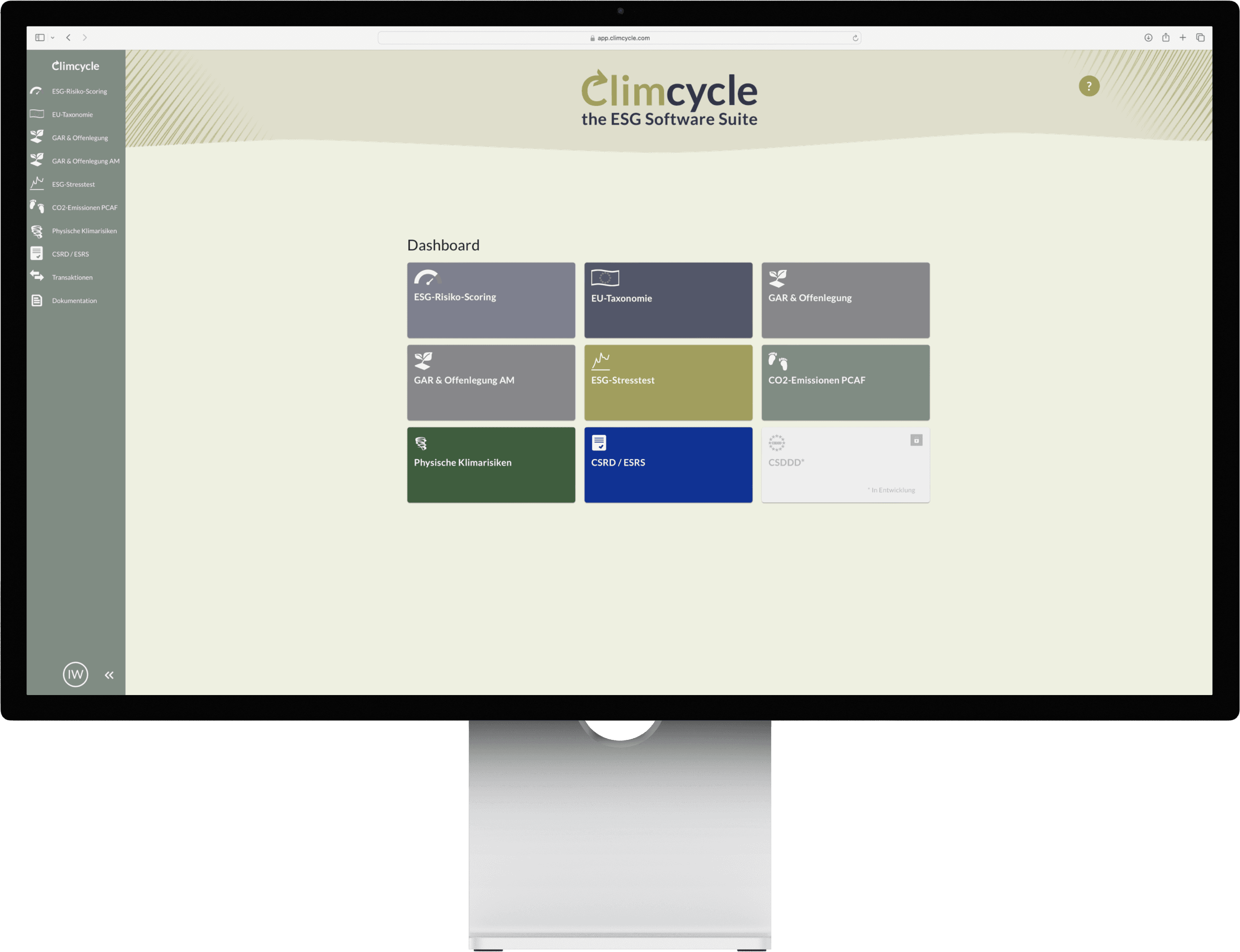

Choose your modules

Customized adjustments

Key features

Being ESG-compliant from a regulatory perspective: that is the purpose of Climcycle's 9 different modules, all working towards a common goal. Whether it's one module or all of them – customize your individual solution.