For Financial Institutions

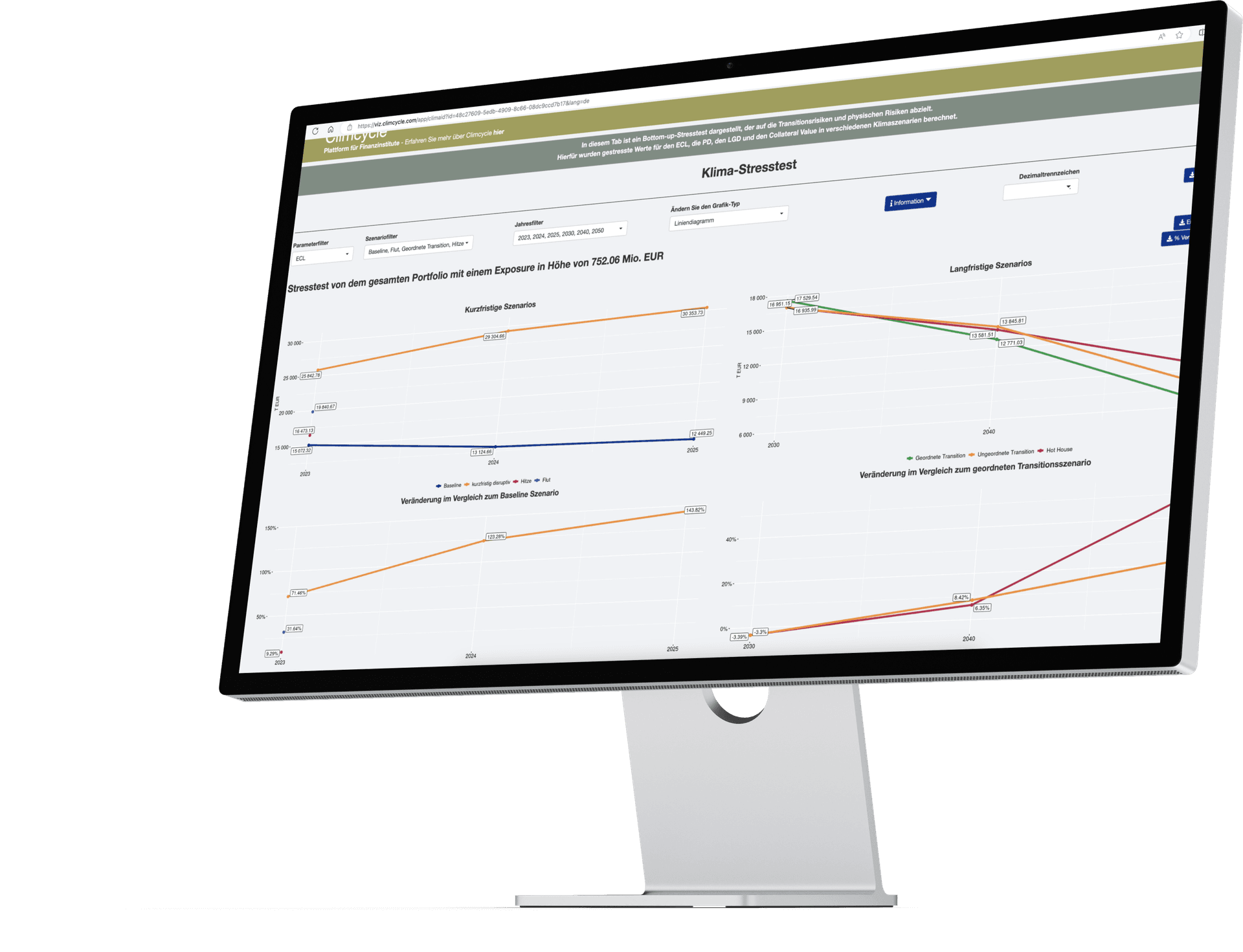

We ensure that everything runs smoothly and simply. The ECB views the climate stress test as a learning process for both banks and supervisory authorities. The stress test aims to identify weaknesses, find best practice solutions, and uncover the biggest challenges for banks in managing climate risks.

All-in-one, always there for you, and sustainably well-designed.

The module utilizes both the stress test parameters provided by the ECB and public variable shift factors that reflect the impact on credit risk parameters. The module’s results include the calculated metrics as well as the stressed credit risk parameters.

The module follows the ECB stress test methodology for 2022 regarding Metrics 1 and 2. Additionally, credit risks are analyzed in short-term scenarios according to the ECB methodology. The forecasts for stressed credit risk parameters are based on shift factors from various regulatory publications, such as those by the ECB or OeNB. Adaptation to internal bank calculations is also possible.

The module covers short-term stress scenarios, physical risks, transition risks, as well as all industries and countries within the scope of the 2022 climate stress test.

The stress test results, along with visualized forms, are available in Climcycle and can be downloaded, making the process stress-free for our clients.

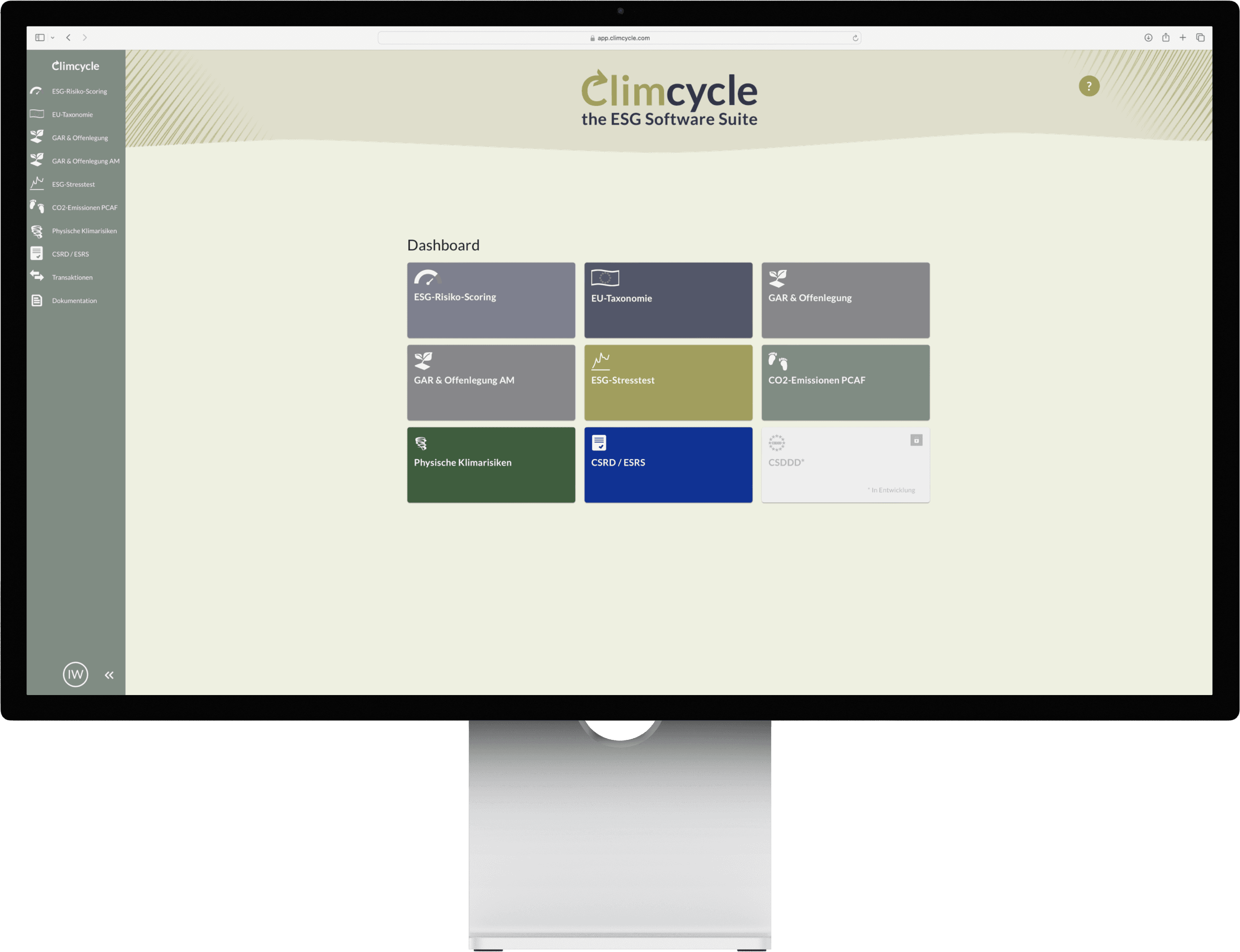

Whether you're a financial institution, insurance company, or industry leader, we provide the solution for all your ESG regulatory needs. With Climcycle, you get a platform tailored to your specific requirements.

Choose your modules

Customized adjustments

Key features

Being ESG-compliant from a regulatory perspective: that is the purpose of Climcycle's 9 different modules, all working towards a common goal. Whether it's one module or all of them – customize your individual solution.