Calculation and disclosure of Green Asset Ratios for financial institutions

There is a clear goal: sustainable business practices. To achieve the EU's 2030 climate goals and the European Green Deal, numerous direct investments in sustainable activities are necessary. To this end, the EU has established a uniform framework for assessing sustainable activities: the EU Taxonomy. This requires banks to disclose the sustainable portion of their financing. Additionally, the BCBS Pillar 3 framework requires the disclosure of other ESG-relevant portfolio information.

All-in-one, always there for you, and sustainably well-designed.

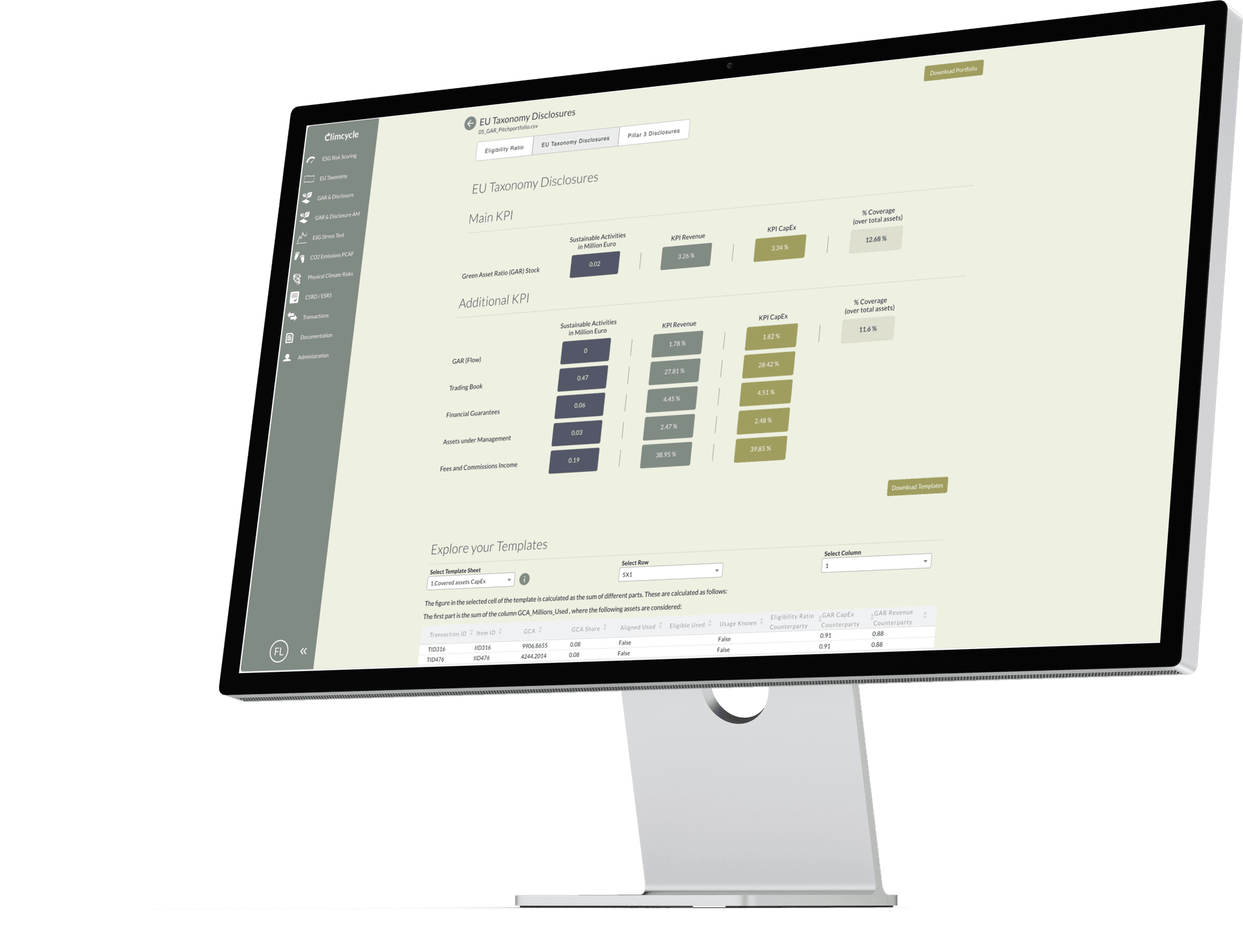

Various data from the financed counterparties are needed to prepare the reporting forms. This includes taxonomy compliance metrics, energy efficiency information, and exposure to physical risks. Climcycle has an internal database with a wide range of the required information, reducing your data collection effort to the bare minimum. All necessary reporting forms are generated, and the KPIs are visualized on the user interface.

The methodology is straightforward: the calculation is performed in accordance with "Delegated Regulation (EU) 2021/2178 of the Commission of July 6, 2021, supplementing Regulation (EU) 2020/852 and the BCBS Pillar 3 framework."

Climcycle has an internal database with much of the necessary information, significantly reducing your data collection effort. All necessary reporting forms are generated, and KPIs are visualized on the user interface.

Climcycle supports you along the way: our module simplifies the calculation of Green Asset Ratios, eligibility Ratios, and the automated filling of all required reporting forms for disclosure under Art. 8 of the EU Taxonomy and Pillar III CRR 449a. Fully automated filling of all regulatory-required templates (EBA) and KPIs. The module documents all processes via an audit trail, keeping you on the regulatory safe side with Climcycle.

Whether you're a financial institution, insurance company, or industry leader, we provide the solution for all your ESG regulatory needs. With Climcycle, you get a platform tailored to your specific requirements.

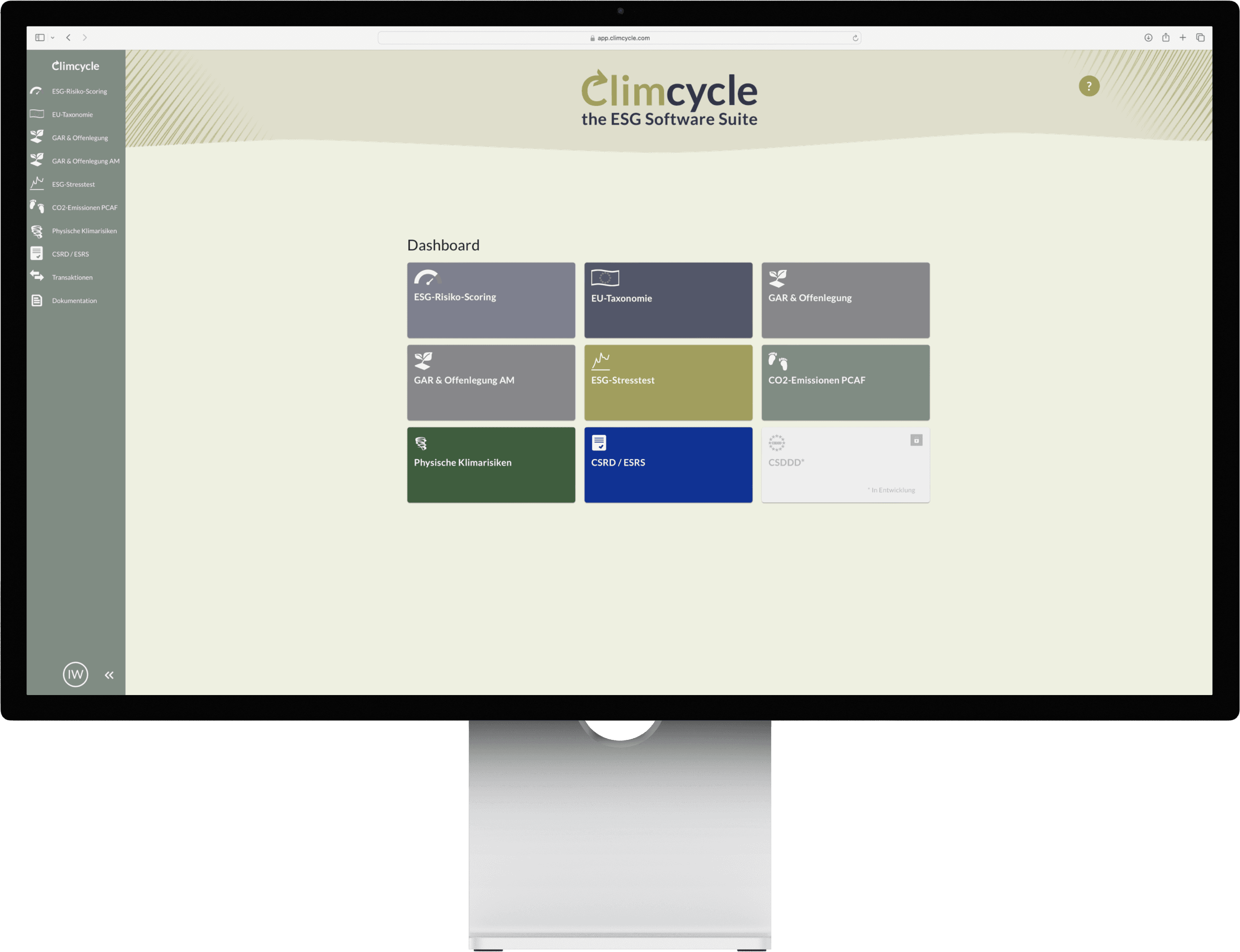

Choose your modules

Customized adjustments

Key features

Being ESG-compliant from a regulatory perspective: that is the purpose of Climcycle's 9 different modules, all working towards a common goal. Whether it's one module or all of them – customize your individual solution.