Non-Financial Reporting according to CSRD

Simply put, the CSRD is a European directive aimed at improving the disclosure of sustainability-related information by companies. It expands the scope of the previous NFRD, with the goal of providing detailed and comparable information on environmental, social, and governance (ESG) aspects. The first companies must comply with CSRD as of January 1, 2025. By 2028, over 50,000 companies in the EU are expected to be affected. From 2029, non-EU companies with significant branches in the EU will also be required to report.

All-in-one, always there for you, and sustainably well-designed.

Input data can be loaded into Climcycle either as an Excel file or directly via API from various databases. All results can be analyzed on our platform or downloaded as an Excel file. There is also the option to integrate with internal and external data systems. All data can be stored and archived directly in the Climcycle cloud environment. Our priority is to make the process simple, hassle-free, and sustainable.

The process is significantly simplified by the extensive automation of regulatory requirements through Climcycle. This includes not only the double materiality analysis but also the fulfillment of specific requirements per ESRS subcategory.

Are you still facing the challenge of a materiality analysis? Our CSRD & ESRS module follows the 'Who? What? Where?' approach, making it easy for you to meet the disclosure obligations of the CSRD & ESRS with its intuitive platform. Subsequently, the specific requirements of the ESRS categories will be automatically populated as much as possible.

Whether you're a financial institution, insurance company, or industry leader, we provide the solution for all your ESG regulatory needs. With Climcycle, you get a platform tailored to your specific requirements.

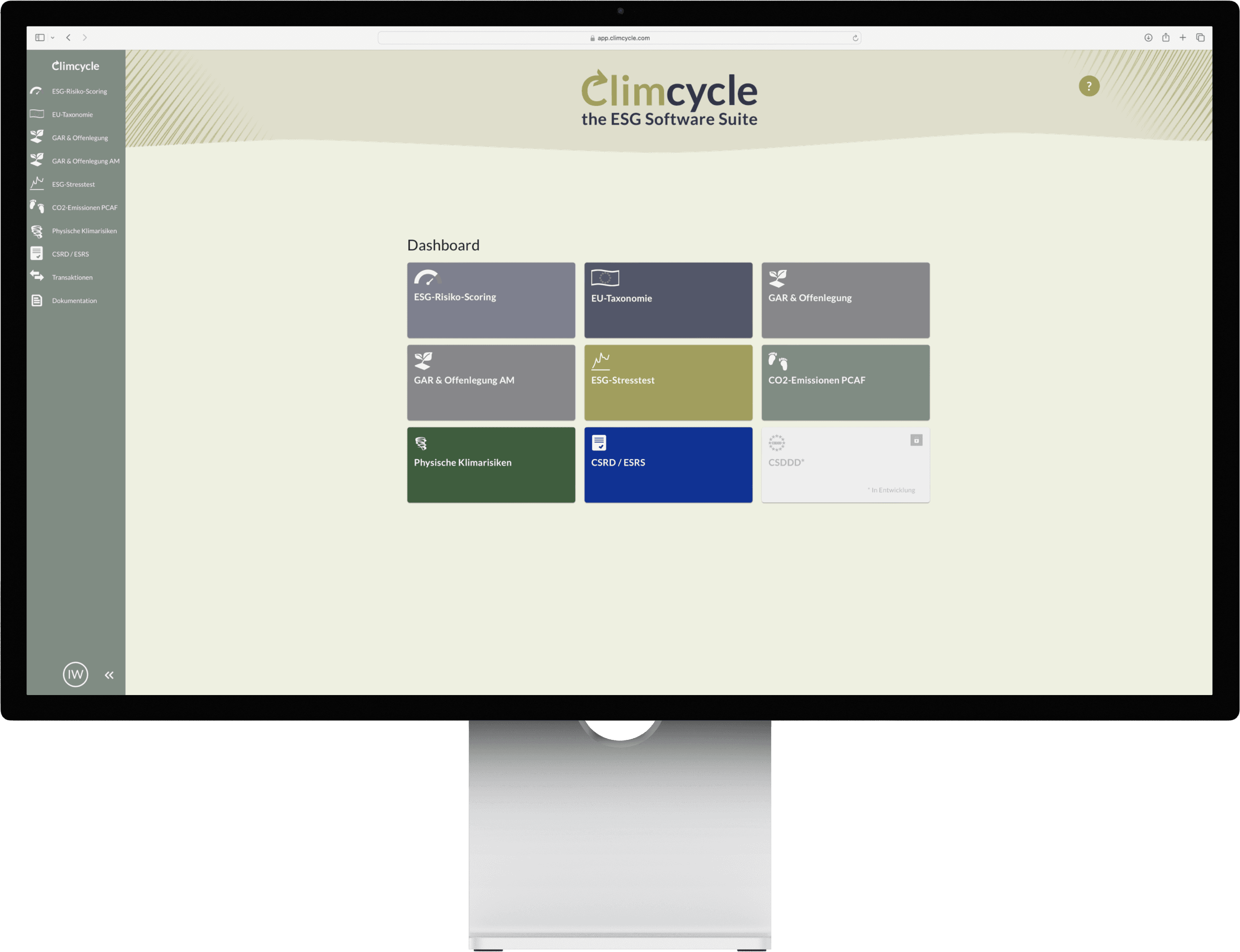

Choose your modules

Customized adjustments

Key features

Being ESG-compliant from a regulatory perspective: that is the purpose of Climcycle's 9 different modules, all working towards a common goal. Whether it's one module or all of them – customize your individual solution.