Identification of ESG risks

Supervisory authorities require adequate consideration of ESG risks in banks' risk management. It is essential that ESG risks are considered like any other significant risks and integrated into processes. This affects, for example, the calculation of IFRS 9 Expected Credit Loss, Internal Rating Based (IRB) model calculations, and pricing in the lending process.

All-in-one, always there for you, and sustainably well-designed.

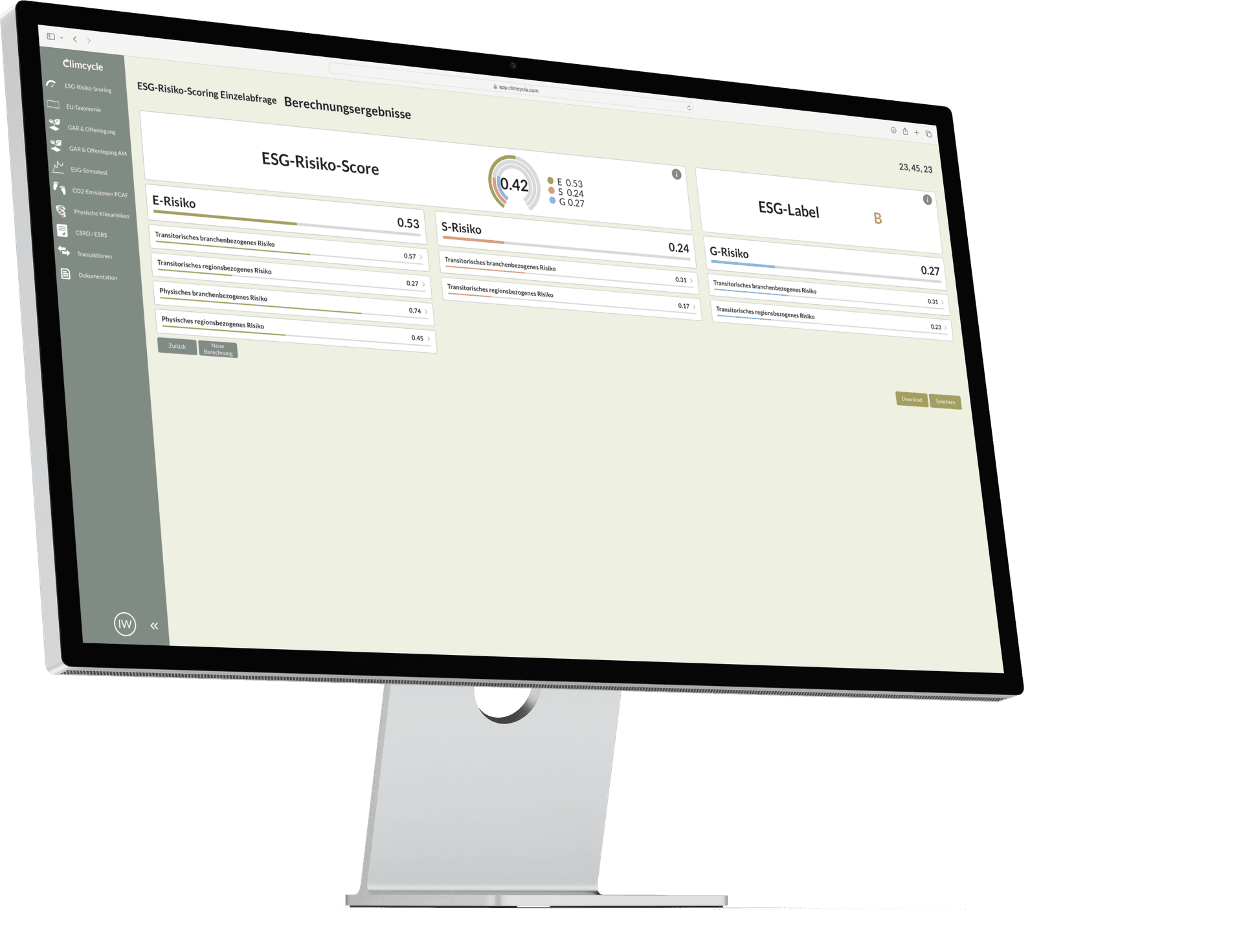

To calculate the individual ESG risk score, Climcycle uses a wide range of data sources on physical risks, transition risks, social risks, and governance risks.

Climcycle allows users to adjust the underlying methodology to individual circumstances. It sounds simple – and it is. Climcycle creates efficient workflows with minimal effort, paving the way to becoming ESG-compliant.

To conduct reliable deal-level analyses, Climcycle relies on highly differentiated data from banks and external data sources. If individual transaction data is unavailable, we use average data for industries and regions. Additionally, existing data sources are updated at least once a year.

Combining different data sources allows our ESG Risk Scoring module to cover all countries and industries at the NACE code level. The industry classification by NACE code ensures simple and standardized data input by financial institutions, plus a clearly differentiated coverage of all industries.

Whether you're a financial institution, insurance company, or industry leader, we provide the solution for all your ESG regulatory needs. With Climcycle, you get a platform tailored to your specific requirements.

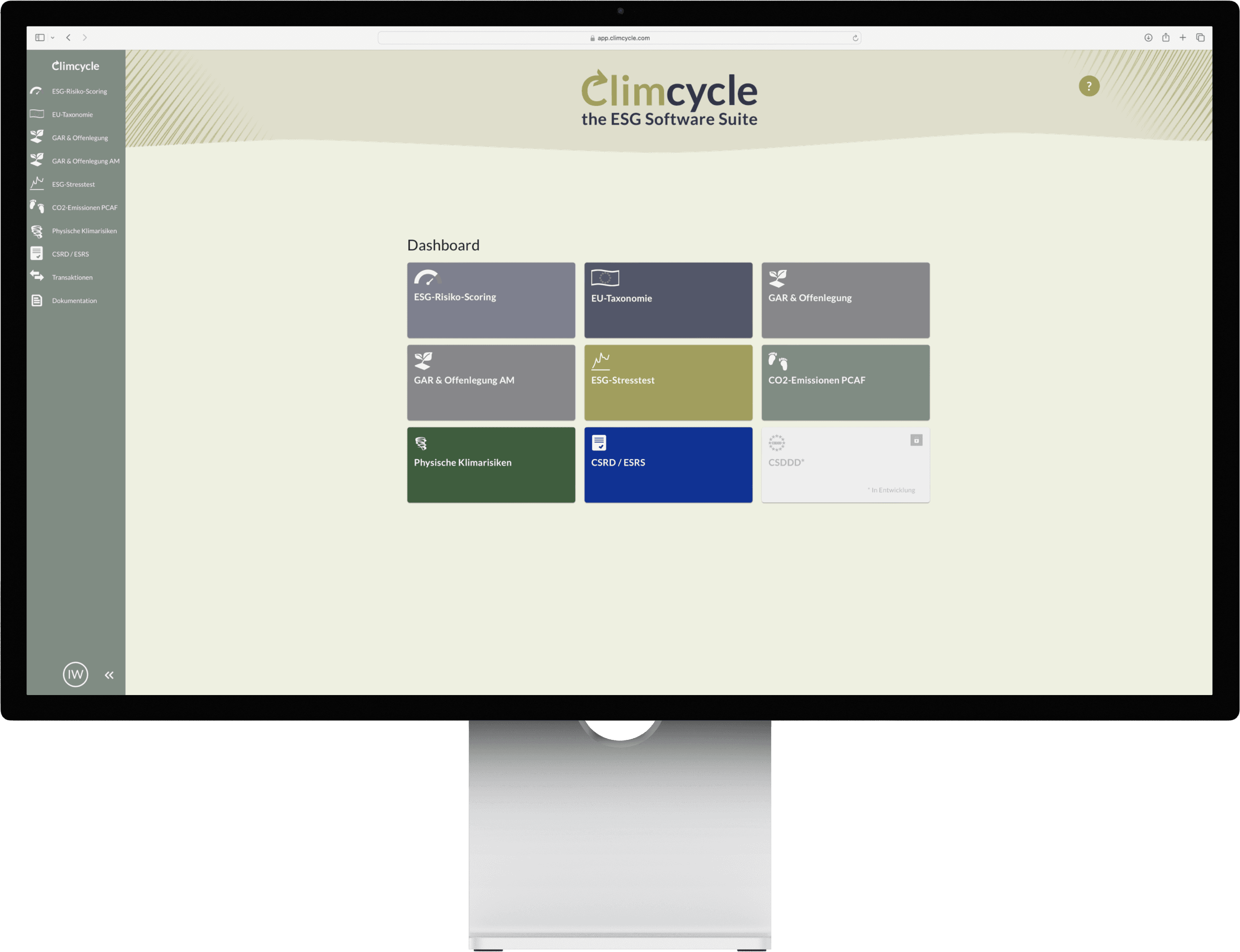

Choose your modules

Customized adjustments

Key features

Being ESG-compliant from a regulatory perspective: that is the purpose of Climcycle's 9 different modules, all working towards a common goal. Whether it's one module or all of them – customize your individual solution.