Whether you're a financial institution, insurance company, or industry leader, we provide the solution for all your ESG regulatory needs. With Climcycle, you get a platform tailored to your specific requirements.

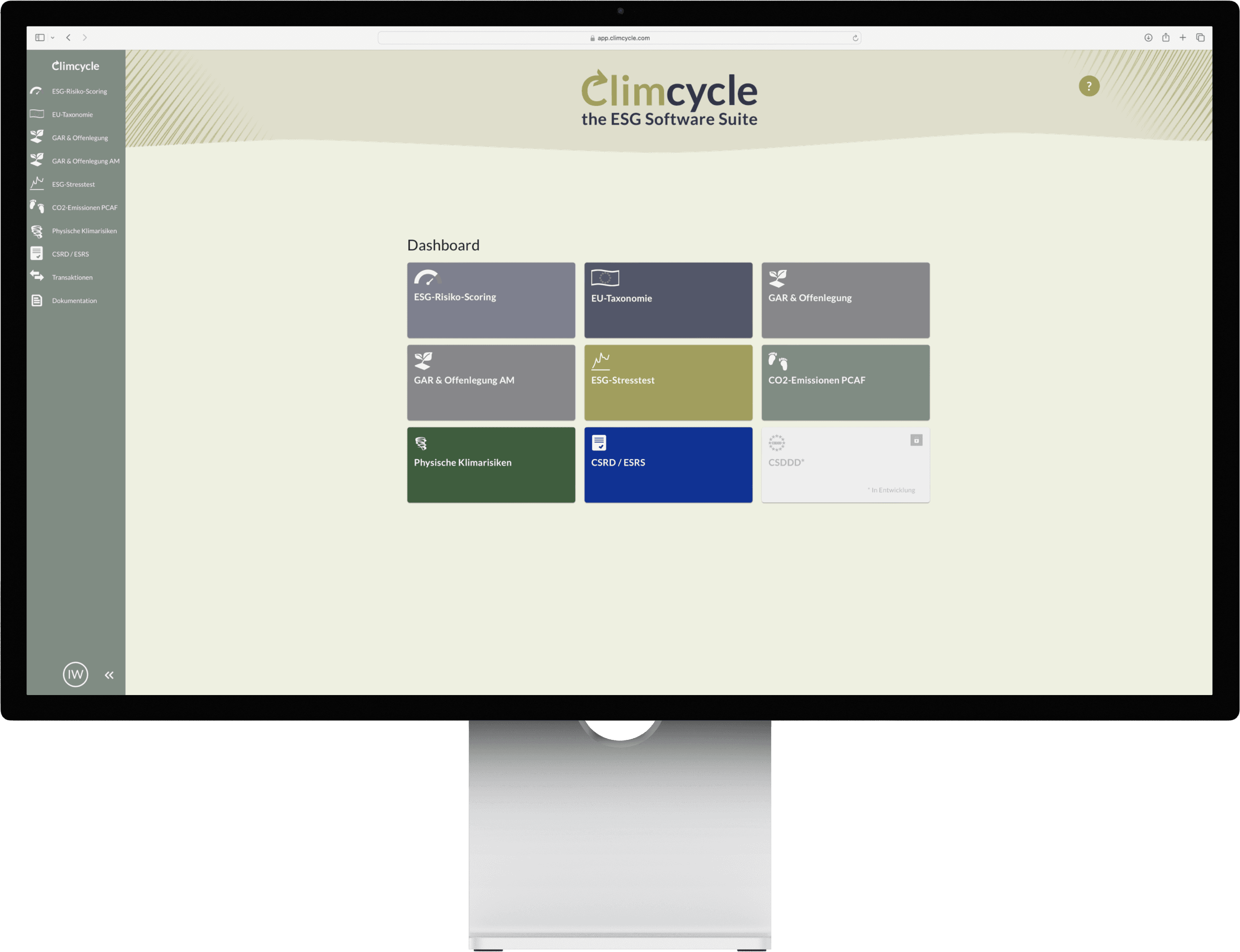

Choose your modules

Customized adjustments

Key features